Early Retirement

| How Much Should You Invest Per Month to Retire Early? |

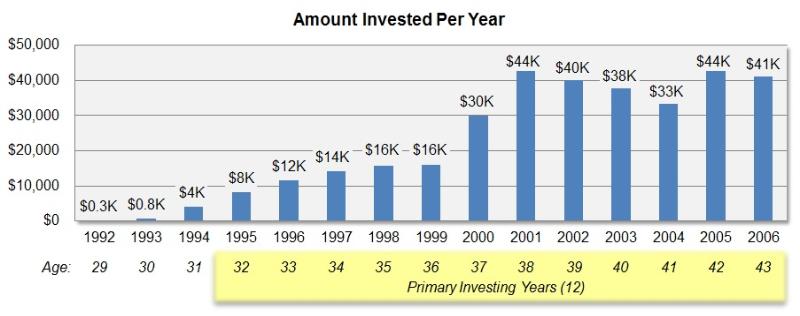

Percentage-wise, that comes out to about 33% of our net income on average

per year. So if you’re saving one-quarter to one-third of your net income, there

is a fair chance you’re on track for early retirement too.

Note the big jump in savings that occurred in 2000 and 2001 due to my wife’s

retraining as a nurse. After paying off her student loans in 2000, we were able

to channel virtually all of the extra money she was earning straight into

investments. The lesson learned is to invest in yourself first if you want to

maximize results.

We kept things simple by investing more or less equal amounts in three

Vanguard index funds: the Vanguard 500 Index Fund (VFINX), Vanguard

Extended Market Index Fund (VEXMX), and Vanguard Total International Stock

Index Fund (VGTSX). We were essentially 100% invested in stocks during our

primary investing years and only added a significant position in bonds upon

selling our home and retiring.

How Much Can YOU Invest Monthly?

What you can accomplish depends a lot on your own situation, of course,

financial and otherwise. Let’s take a look at three different scenarios:

The investing calculator at daveramsey.com (under the “Tools” tab) can be a

great help in testing out different what-if scenarios and monthly investment

amounts.

If all of these amounts seem impossibly large to you, don’t get discouraged:

just consider how little we saved in our first three years. With a long time

horizon, you have plenty of time to make career improvements to supercharge

your savings. Tip: When you get a raise at work, channel the majority of it into

increased savings before you become used to living on the higher amount.

Your monthly savings rate can jump dramatically by following this simple

approach.

Jobs and Kids

Retiring early does not demand a high-powered job but it does require you to

live consistently below your means. We achieved early retirement with no

outside financial help and with combined gross salaries averaging $89,000

over the 15 years from 1992 to 2006. Most people take comfort in hearing we

were able to realize our early retirement dreams with relatively normal jobs.

We can say with certainty we could not have retired at age 43 with kids given

our modest salaries, but we believe we could have retired by age 50. To give

yourself the best chance of success, let compounding do more of the work for

you by investing smaller amounts over a longer period of time. This will give

your investments (and your kids) more time to grow.

per year. So if you’re saving one-quarter to one-third of your net income, there

is a fair chance you’re on track for early retirement too.

Note the big jump in savings that occurred in 2000 and 2001 due to my wife’s

retraining as a nurse. After paying off her student loans in 2000, we were able

to channel virtually all of the extra money she was earning straight into

investments. The lesson learned is to invest in yourself first if you want to

maximize results.

We kept things simple by investing more or less equal amounts in three

Vanguard index funds: the Vanguard 500 Index Fund (VFINX), Vanguard

Extended Market Index Fund (VEXMX), and Vanguard Total International Stock

Index Fund (VGTSX). We were essentially 100% invested in stocks during our

primary investing years and only added a significant position in bonds upon

selling our home and retiring.

How Much Can YOU Invest Monthly?

What you can accomplish depends a lot on your own situation, of course,

financial and otherwise. Let’s take a look at three different scenarios:

- 15-year plan: Based on our own experience, about $24,000 per year or

$2,000 per month is a reasonable investment amount if you’re aiming for

retirement in 15 years. That amount -- plus compounding, plus any

equity if you own a home and are willing to downsize -- may be enough

to allow for a modest early retirement. In our own case, we were able to

downsize to a $100,000 condo once we retired, which let us channel the

other $200,000 from the sale of our home into Vanguard Total Bond

Market Index Fund (VBMFX).

- 20-year plan: The above goal is frankly over-ambitious for most parents.

We would suggest parents aim at saving $15,000 per year or $1,250

per month for 20 years to achieve a roughly similar nest egg result.

- 25-year plan: If you don’t want to scrimp and save quite so much,

another option is $9,000 per year or $750 per month for 25 years. The

power of compounding is such that smaller amounts saved over longer

periods of time can achieve surprisingly effective results.

The investing calculator at daveramsey.com (under the “Tools” tab) can be a

great help in testing out different what-if scenarios and monthly investment

amounts.

If all of these amounts seem impossibly large to you, don’t get discouraged:

just consider how little we saved in our first three years. With a long time

horizon, you have plenty of time to make career improvements to supercharge

your savings. Tip: When you get a raise at work, channel the majority of it into

increased savings before you become used to living on the higher amount.

Your monthly savings rate can jump dramatically by following this simple

approach.

Jobs and Kids

Retiring early does not demand a high-powered job but it does require you to

live consistently below your means. We achieved early retirement with no

outside financial help and with combined gross salaries averaging $89,000

over the 15 years from 1992 to 2006. Most people take comfort in hearing we

were able to realize our early retirement dreams with relatively normal jobs.

We can say with certainty we could not have retired at age 43 with kids given

our modest salaries, but we believe we could have retired by age 50. To give

yourself the best chance of success, let compounding do more of the work for

you by investing smaller amounts over a longer period of time. This will give

your investments (and your kids) more time to grow.

| Originally published in Motley Fool |

Nobody’s saying it’s easy to retire early on an average salary, but it’s not

impossible either. It took us 15 years to “get rich slowly,” investing steadily

month by month until we had amassed a nest egg of nearly $1 million --

enough to safely generate about $40,000 per year. We’ve been retired for

nearly ten years now and have found we can live comfortably if frugally on this

amount while still traveling extensively.

How Much We Invested Monthly

If you add up the total amount we invested over the 15 years from 1992 to

2006 (the year in which we retired), it comes to $342,000. This is the amount

we put in, not counting compounding due to market returns. That averages out

to $22,800 per year or $1,900 per month.

The first 3 years of this 15-year period were insignificant in terms of investing

because we were focused on buying and furnishing our home, paying off

loans, and switching to a 15-year mortgage. During our 12 primary investing

years we averaged just over $28,000 per year or $2,333 per month in

investments.

impossible either. It took us 15 years to “get rich slowly,” investing steadily

month by month until we had amassed a nest egg of nearly $1 million --

enough to safely generate about $40,000 per year. We’ve been retired for

nearly ten years now and have found we can live comfortably if frugally on this

amount while still traveling extensively.

How Much We Invested Monthly

If you add up the total amount we invested over the 15 years from 1992 to

2006 (the year in which we retired), it comes to $342,000. This is the amount

we put in, not counting compounding due to market returns. That averages out

to $22,800 per year or $1,900 per month.

The first 3 years of this 15-year period were insignificant in terms of investing

because we were focused on buying and furnishing our home, paying off

loans, and switching to a 15-year mortgage. During our 12 primary investing

years we averaged just over $28,000 per year or $2,333 per month in

investments.